Superannuation is a sticky industry. Most Australians remain with their default fund, and even those who consider switching often fall back on what is familiar. Yet with over 600 participants in our latest study who are actively looking to move funds within the next 12 months, Global Reviews uncovered where funds win and lose switchers - and what it will take to convert intent into action.

Awareness is still the biggest barrier

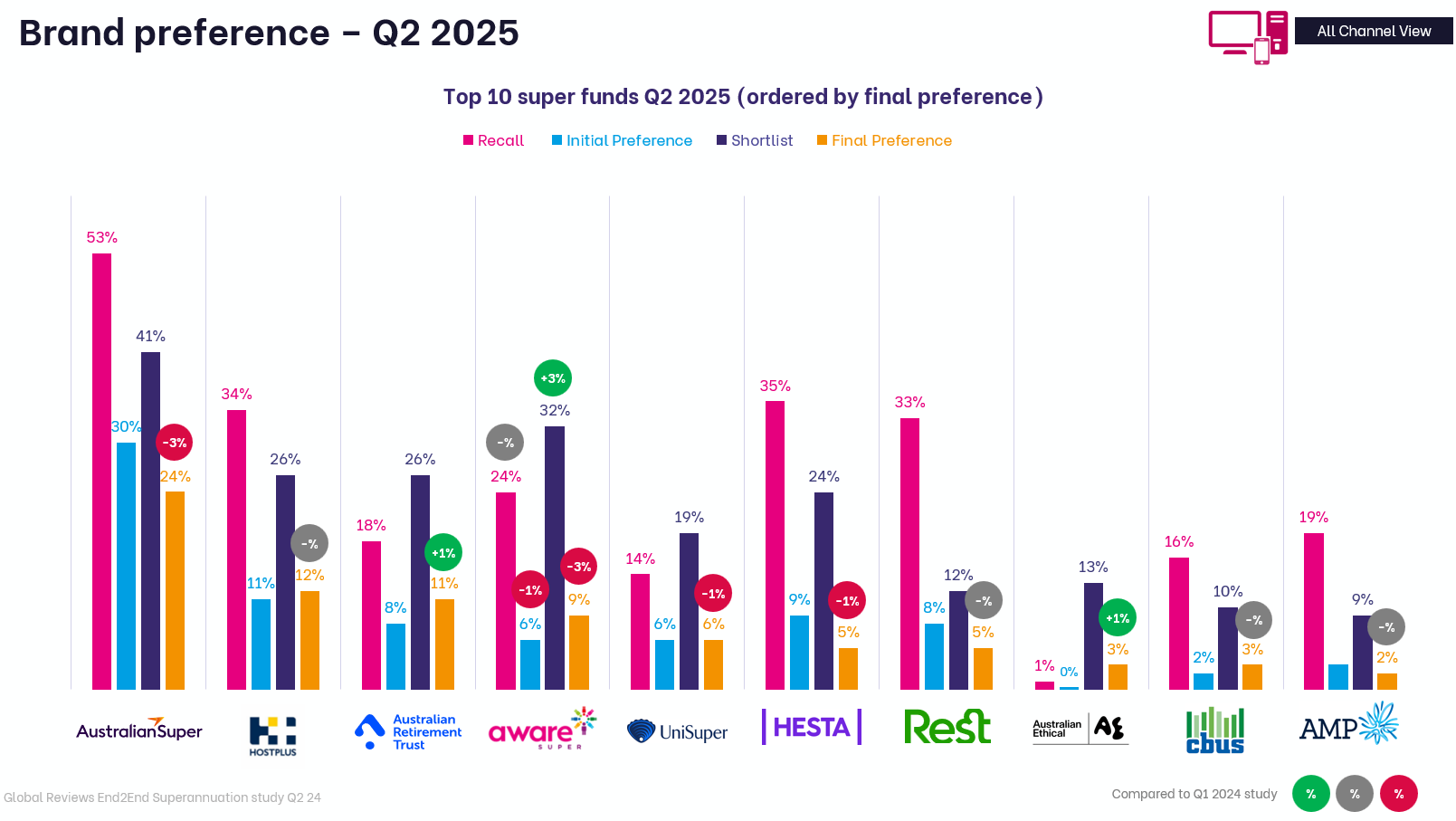

Before anyone opens a comparison site or fund website, brand recall sets the battlefield. AustralianSuper and Hostplus dominate here, sitting top - of - mind for most prospects.

This matters because funds that are remembered first are far more likely to be shortlisted and chosen later. Familiarity equals trust in this category, and if a fund is not even in the mental set, it misses out before the journey begins. Sustained brand campaigns and visible third - party endorsements are key to overcoming this hurdle.

Just appearing online isn’t enough to convert

Aware Super offers a cautionary tale. It is shortlisted by 32% of switchers - second only to AustralianSuper. But when final choices are made, preference drops sharply to 9%. In other words, 71% of people who shortlist Aware defect to someone else.

Why? Prospects tell us they see Aware as competitive on fees and returns, but less convincing on trust, reputation, and differentiation.

Brands like Hostplus and ART pull ahead by distilling their value propositions into simple, scannable proof points: clear 10 - year returns, straightforward fee tables, and prominent industry - fund messaging. Switchers want clarity and reassurance, and they reward the brands who provide it.

Trust rebounds late in the journey

Our research shows an interesting pattern. At the start, reputation and familiarity dominate. In the middle, when people are comparing numbers, trust temporarily recedes. But when it comes time to choose, trust bounces back as the second - strongest driver (43%), just behind fees (44%).

The lesson for funds? Don’t wait until someone is already a member to build trust. Highlight security, governance, ESG commitments, and independent proof points during the switching journey. UniSuper provides a strong example, with website cards that address market volatility, cyber security, and ESG values upfront - signalling safety and responsibility before pushing products.

Digital experience has surged in importance

While fees and trust remain the decisive drivers of final preference, one of the strongest growth areas is ease of use. By 2025, nearly half of switchers (49%) say they chose a fund because its website was “easy to understand and use” - well above the market average of 34%.

This is a clear warning sign for funds that bury information in heavy copy or cluttered designs. One participant summed it up: “The whole site is confusing and cluttered… I couldn’t figure out what made them different.”

Digital clarity doesn’t just aid comprehension - it builds confidence. A smooth, transparent online journey signals that a fund has nothing to hide and respects a prospect’s time.

Comparison sites are the battleground

40% of those that chose a new super fund different to their current provider use platforms like Finder or Canstar. These sites don’t just funnel traffic - they actively shift preferences.

- Visiting Canstar boosts Aware Super’s preference by 12 points, thanks to strong fee disclosure, awards, and top - quartile returns.

- Finder, on the other hand, disproportionately lifts Hostplus, with clear low - fee positioning and high returns.

- Government’s ATO YourSuper tool nudges preferences toward ART, who benefit from favourable placement and transparent return ranges.

For funds, the implication is simple: optimise for comparison sites, not just your own. Crisp data, consistent awards, and transparent long - term returns are critical in these environments.

Segment differences matter

Switching behaviour isn’t uniform.

- 18 – 29-year-olds are least likely to switch, defaulting to trust and low fees. They rely less on comparison sites.

- 30 – 49-year-olds are the most active switchers, prioritising fees, and reputation. They are also the most engaged with sustainable and ethical investment options.

- 50+ members are highly motivated by transparency and detailed asset breakdowns. They weigh trust and reputation more heavily and still use comparison tools, but to validate rather than discover.

Tailoring content and campaigns to these cohorts ensures funds don’t dilute messaging by trying to be everything to everyone.

Practical steps funds can take

From the study, five clear actions emerge for any fund serious about winning switchers:

- Boost brand familiarity - sustained campaigns, visible partnerships, and long - term awards to cement trust.

- Display trust cues early - highlight cyber security, ESG commitments, governance, and member - first proof points.

- Simplify digital journeys - scannable tables, clean layouts, and comparison shortcuts instead of copy - heavy pages.

- Optimise for comparison sites - ensure Canstar, Finder and ATO profiles are accurate, competitive and award - rich.

- Segment your strategy - target younger cohorts with low - fee transparency, mid - career switchers with sustainability and value, and older members with depth on returns, stability, and service.

Closing the conversion gap

Switchers are motivated, but they’re also risk - averse. They want proof, reassurance, and simplicity. The funds that succeed will be those who meet them halfway - balancing rational metrics (fees, returns) with emotional cues (trust, familiarity, clarity).

In an industry where inertia dominates, the real battle is not just getting shortlisted but closing the final mile.